Navigating the world of compliance can often feel overwhelming, especially when it comes to the paperwork involved. Among these forms is the BOIR Form, a critical document that many individuals and businesses need to understand and complete accurately. But what exactly is the BOIR Form, and why does it matter? Whether you’re new to this form or have encountered it before, getting a clear grasp on its requirements is essential for staying compliant and avoiding pitfalls. Let’s dive deeper into everything you need to know about the BOIR Form so you can approach it with confidence.

Understanding the BOIR Form

The BOIR Form, or Business Operations Information Report, is designed to gather essential data about businesses operating in specific sectors. This form plays a pivotal role in ensuring transparency and accountability within various industries.

Filling out the BOIR Form helps regulatory bodies keep track of business operations. It provides valuable insights into company structures, financial performance, and operational practices.

Understanding its nuances can empower business owners to comply with legal requirements seamlessly. The information collected through this form contributes to broader efforts aimed at promoting fair competition and ethical practices.

It’s not just another piece of paperwork; it serves as a cornerstone for informed decision-making by regulators and stakeholders alike. Familiarity with the BOIR Form will enhance your ability to navigate compliance challenges effectively.

The Purpose of the BOIR Form

The BOIR Form serves a critical role in regulatory compliance. It provides a standardized way for businesses to report specific information regarding their operations.

This form is primarily used to disclose ownership structures and financial interests within an organization. By accurately completing the BOIR Form, companies ensure that they are transparent about who holds control or influence over their assets.

Moreover, the form helps authorities monitor potential risks associated with money laundering and other illegal activities. Compliance fosters trust between businesses and regulators.

Having this transparency not only protects your business but also contributes positively to the overall industry landscape. Understanding its purpose can empower organizations to navigate complex regulations more effectively.

Who Needs to Fill Out the BOIR Form?

The BOIR Form is essential for various stakeholders. Primarily, individuals and organizations engaged in specific industries must complete this form to ensure compliance with regulatory standards.

Businesses that operate in sectors governed by local or national regulations are typically required to submit the BOIR Form. This includes financial institutions, healthcare providers, and companies dealing with environmental impact.

Moreover, anyone involved in mergers or acquisitions may need to fill it out. It’s crucial for transparency during significant business transitions.

Nonprofit organizations seeking grants might also find themselves needing the BOIR Form. Compliance helps maintain legitimacy and accountability within their financial practices.

Independent contractors working on government projects should be aware of this requirement as well. Understanding who needs to file ensures that all parties stay informed about their obligations under current regulations.

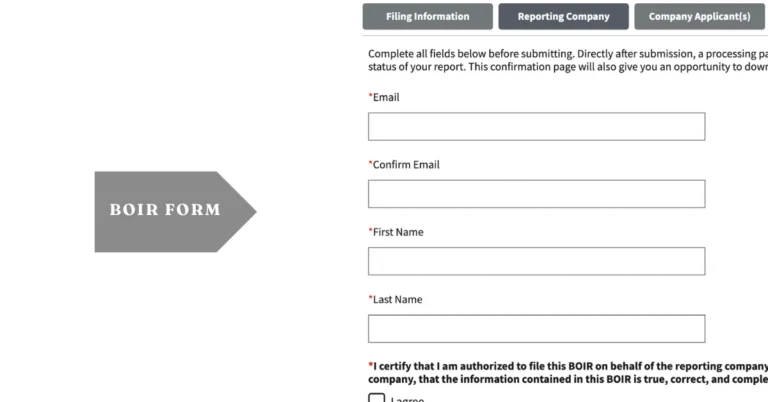

Steps for Filling Out the BOIR Form

Filling out the BOIR Form requires careful attention. Start by gathering all necessary documentation. This might include your business license and identification details.

Next, read through the form carefully before you start filling it out. Understanding what information is required can save time later on.

As you fill in each section, ensure accuracy. Double-check spelling and numbers to prevent any errors that could delay processing.

Don’t forget to provide any requested signatures or endorsements where applicable. Missing a signature may result in rejection of your application.

If you’re unsure about certain sections, consider seeking help from professionals or resources online. Clarity is key when completing this important document.

Review the entire form once more before submission to make sure everything aligns correctly with your supporting documents.

Common Mistakes to Avoid When Completing the BOIR Form

Completing the BOIR Form can be tricky, and many people make common mistakes that could lead to delays or even rejections. One frequent error is overlooking required fields. Always double-check that every section is filled out accurately.

Another mistake involves providing incorrect information. Even a minor typo can cause issues down the line, so take your time when entering details like names or addresses.

Failing to sign and date the form is another oversight that often occurs. Remember, an unsigned document may be considered incomplete by authorities.

Additionally, submitting outdated versions of the BOIR Form can also create complications. Ensure you’re using the most recent version available for compliance.

Not keeping a copy for your records might seem trivial but can save you headaches later if questions arise about what was submitted.

Importance of Compliance with the BOIR Form

Compliance with the BOIR Form is not just a legal obligation; it’s a crucial aspect of maintaining organizational integrity. Filling out this form accurately ensures transparency and accountability in your operations.

Failing to comply can lead to significant penalties, including fines or even legal action. These repercussions can tarnish an organization’s reputation and disrupt its activities.

Moreover, proper compliance fosters trust among stakeholders—clients, partners, and regulatory bodies alike. When everyone knows that you adhere to standards, it strengthens relationships and builds confidence in your business practices.

Additionally, being proactive about compliance helps identify potential issues before they escalate. This foresight can save time and resources down the line.

Understanding the importance of complying with the BOIR Form cultivates a culture of responsibility within your organization while safeguarding its future success.

Conclusion

Navigating compliance requirements can be challenging, but understanding the BOIR Form is essential for maintaining legal and regulatory standards. This form serves a crucial purpose in various sectors, ensuring transparency and accountability.

Identifying who needs to fill out the BOIR Form clarifies your responsibilities. Whether you’re an individual or part of an organization, knowing your obligations helps streamline processes. Following the outlined steps carefully will make completion easier and more efficient.

Avoiding common mistakes while filling out this form can save time and prevent potential issues down the line. Awareness of these pitfalls encourages diligence during completion.

Staying compliant with the BOIR Form isn’t just about following rules; it fosters trust within your community or industry. Proper adherence demonstrates professionalism and commitment to ethical practices.

Understanding all aspects related to the BOIR Form empowers individuals and organizations alike. It’s not merely a piece of paperwork; it’s a vital tool for success in today’s regulatory environment. Keeping updated on requirements will enhance both personal growth and organizational integrity going forward.

FAQs

Q: What is the BOIR Forms?

Ans: The BOIR Forms, or Beneficial Ownership Information Report, is a mandatory document for certain businesses to disclose details about their beneficial owners, ensuring corporate transparency.

Q: Who is required to file the BOIR Forms?

Ans: Businesses operating in the United States that meet specific criteria, such as corporations and LLCs, must file the BOIR Forms to comply with federal regulations.

Q: Why is the BOIR Forms important?

Ans: The BOIR Forms helps prevent illicit activities like money laundering, tax evasion, and fraud by identifying and disclosing beneficial owners of businesses.

Q: What happens if I fail to file the BOIR Forms?

Ans: Failure to file the BOIR Forms correctly or on time can result in significant penalties, including fines or legal repercussions.

Q: How can I ensure compliance with BOIR Forms requirements?

Ans: To ensure compliance, familiarize yourself with BOIR Forms guidelines, provide accurate ownership details, and consult legal or financial experts if needed.