Investing in index funds can be a game-changer for those looking to build wealth over time. With so many options available, choosing the right fund can feel overwhelming. Two popular choices that often come up in discussions are VOO vs VFIAX. Both track the performance of the S&P 500, but they have some key differences that could impact your investment strategy.

If you’re curious about how VOO and VFIAX stack up against each other, you’re in the right place. This guide will break down their unique features, fees, performance metrics, and more to help you make an informed decision. Whether you’re a seasoned investor or just starting out, understanding these two funds will equip you with valuable insights for your portfolio journey. Let’s dive into what sets these funds apart!

Understanding Index Funds

Index funds are investment vehicles designed to mirror the performance of a specific market index. They allow investors to gain exposure to a broad range of stocks without having to pick individual securities.

The appeal lies in their simplicity and efficiency. Instead of trying to outsmart the market, investors can buy into an index fund that reflects the entire market or a segment of it. This passive approach often results in lower costs compared to actively managed funds.

Another advantage is diversification. By investing in an index fund, you automatically own shares of many companies across various sectors. This spread reduces risk since you’re not reliant on the success of just one stock.

In essence, index funds democratize investing by making it accessible and straightforward for everyone—from beginners to seasoned pros.

Introduction to VOO and VFIAX

VOO and VFIAX are two popular investment options that track the performance of the S&P 500 index.

VOO is an exchange-traded fund (ETF), while VFIAX is a mutual fund. Both allow investors to gain exposure to large-cap U.

S. stocks without buying individual shares.

The Vanguard S&P 500 ETF, or VOO, trades like a stock on exchanges, providing flexibility in buying and selling throughout the day. This makes it appealing for active traders.

On the other hand, VFIAX operates as a mutual fund with trading occurring at market close. It’s ideal for long-term investors who prefer dollar-cost averaging through automatic contributions.

Both funds share similar objectives but cater to different investing styles. Understanding these distinctions helps you choose what aligns best with your financial goals and strategies.

Expense Ratios and Fees

Expense ratios and fees can significantly impact your investment returns over time. VOO, the Vanguard S&P 500 ETF, boasts a low expense ratio of just 0.03%. This makes it an appealing choice for cost-conscious investors looking to maximize their gains.

On the other hand, VFIAX is Vanguard’s mutual fund version of the same index. It has a slightly higher expense ratio at around 0.04%. While this difference may seem minimal, it’s essential to consider how these costs accumulate with larger investments over many years.

Both options have no load fees, which means you won’t incur additional charges when buying or selling shares. Still, assessing how each fund’s expenses fit into your overall investment strategy is crucial for long-term success in building wealth through index funds like these.

Diversification and Tracking Error

Diversification is a key principle in investing. It helps mitigate risks by spreading investments across various sectors and asset classes. Both VOO and VFIAX aim to provide broad exposure, but they do it in slightly different ways.

VOO tracks the S&P 500 index using an exchange-traded fund structure. This means you can buy it like a stock, benefiting from real-time trading throughout the day. Its diversified holdings include large-cap U.

S. companies.

On the other hand, VFIAX is a mutual fund that also mirrors the S&P 500. However, it’s designed for investors who prefer traditional mutual funds with lower minimum investment requirements.

Tracking error measures how closely an investment follows its benchmark index. A lower tracking error indicates better performance alignment with the index itself—an important factor when evaluating these two options for your portfolio strategy.

Investment Performance Comparison

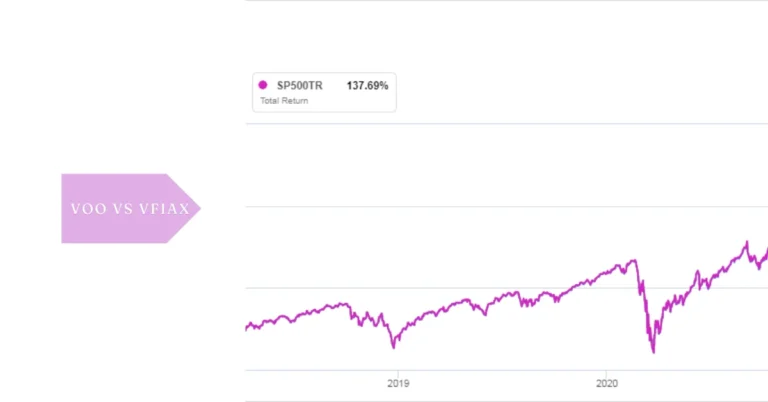

When comparing the investment performance of VOO and VFIAX, historical returns play a significant role. Both funds aim to track the S&P 500, but their structures can lead to slight variations in results.

VOO is an exchange-traded fund (ETF), which generally trades close to its net asset value throughout the day. This trading mechanism often allows for quicker responses to market fluctuations.

VFIAX, on the other hand, is a mutual fund that only processes purchases and sales at the end of each trading day. This means investors may miss out on intraday price movements when investing in VFIAX.

Over longer periods, both funds have shown competitive returns relative to their benchmarks. However, performance can vary slightly based on factors like fees and tracking error.

Investors should examine these nuances closely as they make their decision between VOO and VFIAX.

Risk Factors to Consider

When evaluating VOO and VFIAX, it’s vital to consider the inherent risks associated with both investments. Market volatility can significantly impact your returns. Both funds track the S&P 500, which means they are subject to fluctuations based on broader market trends.

Another factor is liquidity risk. While both options are generally liquid, their trading volumes can vary. This may influence how quickly you can buy or sell shares without affecting the price significantly.

Additionally, expenses play a role in your net returns over time. Although both have low expense ratios compared to many mutual funds, even small differences matter when compounded over years.

Investor behavior adds an unpredictable element. Emotional reactions during downturns might lead some investors to panic-sell at inopportune times. Understanding these dynamics will help you make informed choices about each fund’s suitability for your portfolio.

Which One is Right for You?

Choosing between VOO and VFIAX largely depends on your investment goals and preferences. If you prefer an exchange-traded fund (ETF) structure, then VOO might be your go-to option. It offers flexibility in trading, allowing you to buy or sell shares throughout the day.

On the other hand, if you’re inclined towards mutual funds, VFIAX could be more appealing. It’s a good fit for investors who want to invest through regular contributions without worrying about market fluctuations during the day.

Consider your investment horizon as well. Long-term investors may find both options equally suitable due to their similar underlying index exposure.

Evaluate how much liquidity you need too. If quick access is crucial for your strategy, go with VOO’s trading capabilities. For those who prioritize dollar-cost averaging over time, sticking with VFIAX can simplify that process seamlessly.

Conclusion

When it comes to choosing between VOO and VFIAX, understanding your investment goals is crucial. Both funds offer exposure to the S&P 500 but cater to different types of investors. If you prefer a low-cost ETF with flexibility in trading, VOO may be the way to go. On the other hand, if you’re looking for a mutual fund that allows for automatic investments and dollar-cost averaging, VFIAX could suit your needs better.

Consider factors like expense ratios, diversification strategies, and risk tolerance as you weigh your options. Each fund has its unique features that can align differently with individual financial situations and investment styles. Whether you choose VOO or VFIAX should depend on what resonates best with your portfolio strategy and financial objectives. Making an informed choice will help set the foundation for long-term success in your investing journey.

FAQs

Q: What is the main difference between VOO and VFIAX?

Ans: VOO vs vfiax is an ETF that tracks the S&P 500, while VFIAX is a mutual fund with the same objective. VOO trades like a stock, and VFIAX is bought through a mutual fund account.

Q: Which has lower expense ratios, VOO or VFIAX?

Ans: VOO vs vfiax generally has a lower expense ratio compared to VFIAX, making it slightly cheaper to own over time.

Q: Can I purchase VFIAX through a brokerage account?

Ans: No, voo vs VFIAX is only available directly from Vanguard, whereas VOO can be purchased through any brokerage account.

Q: How do dividends differ between VOO and VFIAX?

Ans: Both VOO vs VFIAX pay dividends based on the S&P 500, but VOO’s dividends are reinvested automatically if you choose that option, while VFIAX distributes dividends as cash or reinvestments based on your preference.

Q: Is there a difference in liquidity between VOO and VFIAX?

Ans: Yes, VOO vs vfiax, being an ETF, typically offers higher liquidity and easier trading flexibility compared to VFIAX, a mutual fund with daily trading.